Sign up for the 401k

Before April 1st

No matter where you are on the road to retirement, saving is the right thing to do. And now's the time to start because the sooner you save, the more time your money has to work for you.

Just take this step: Enroll in the Glass Family of Companies 401(K) PLAN. It doesn't take a lot of time or money to get started.

With your plan in place, you'll have the support you need to save and invest:

Your retirement plan website

rps.troweprice.com

Dedicated representatives

1-800-354-2351 business days between 7 a.m. and 10 p.m. eastern time.

Mobile solutions

Connect to your account on any device. Visit troweprice.com/mobilesolutions to choose the option that's best for you.

Glass Family of Companies. has chosen T. Rowe Price, a recognized leader in retirement plan services, to provide services to you and your plan. We

currently help nearly 2 million people just like you plan for retirement.

We are ready to help you feel confident about taking the first step. As your life changes, talk to us. We can provide information to help you make

progress toward your long-term financial goals.

Let's get started.

You can take these steps right now at rps.troweprice.com.

It doesn't take long, and it's time well-spent.

Read on for help with these steps and more. Or give us a call at 1-800-354-2351.

When you enroll, don't forget to do these two things:

Name your beneficiary. Make sure your savings will go to the person or people you choose. You can do this online at rps.troweprice.com.*

Verify your preferred e-mail. Visit rps.troweprice.com and provide an e-mail address so that you can receive timely, helpful information about your plan.

*If online enrollment and/or beneficiary updates are not offered in your plan, you can download the required forms at rps.troweprice.com.

Saving for retirement–don't put it off.

You may think you have more pressing needs than saving for retirement, but you only have so many working years to save enough for the future.

Here are a few more reasons why you shouldn't wait:

You may need more money in retirement than you think.

People are living longer. In fact, your nest egg may need to last 30 years or more.

You may not be able to count on Social Security.

To maintain the lifestyle you're used to, you may need more retirement income than Social Security alone will provide.

Your living costs may keep going up.

Inflation averages about 3% every year-meaning the cost of everything is likely to keep rising.

Taking a step—like enrolling in the Glass Family of Companies 401(K) PLAN—can help you start saving the money you'll need to enjoy the future you want.

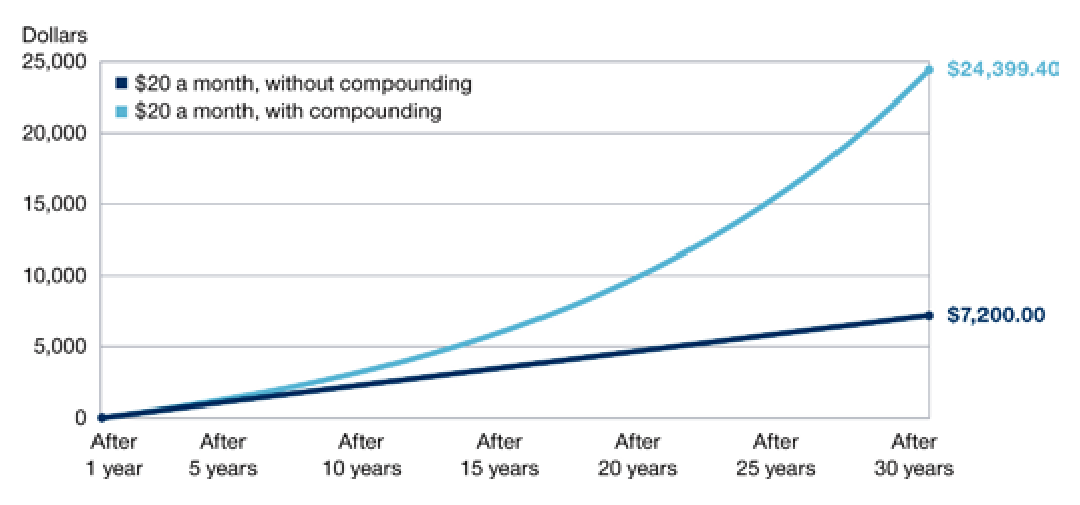

Compounding: Another reason to save now.

When you invest through the plan, any earnings are put right back into your account. The longer your money stays invested, the more it can potentially earn through compounding—so it's important to start now. Saving even a small amount in the plan can make a difference. Consider this example:

*Chart assumes a 7% annual return, net of fees, with earnings compounded monthly. Chart is for illustrative purposes only and does not represent the performance of any of your plan's investment options. All investing is subject to market risk, including the potential loss of principal.

We're with you, each step of the way.

Here are the steps for getting started in the plan with tips to help you fit it into your life.

Your plan makes it convenient to save with every paycheck. The important thing is to choose a savings amount and get started. See the section titled "Get to know all the ways your plan can work for you" for contribution types, amounts, and services available to you.

When you go to enroll and make your selections, remember: It's ok to start small. Building up your savings takes time, so the sooner you start, the better.

Here are a few tips to make saving for retirement less stressful for you:

Right now, simply save what you can.

Just a little bit of savings today can go a long way in retirement. Consider setting aside 1% or 2% of your pay now—for many, that's a few dollars a week—and increase the amount by 1% or 2% each year.

Consider where you are now

your age, salary, and monthly budget. These factors will impact how much you save for retirement. You can try out different contribution amounts and see the impact on your paycheck by using the Paycheck Impact Calculator at rps.troweprice.com.

Make the most of your employer contribution.

Glass Family of Companies. may offer additional money for your retirement. Read on to learn how an employer contribution can add to your savings.

Work toward a goal of 15%.

Financial experts believe you should save that much of your pay for retirement, including your retirement plan contributions and any employer contributions. That may seem like a lot, but if you can increase your savings a little each year, you can get there.

Your plan may offer various options for how much you contribute. You'll find the contribution choices offered by your plan in this guide. Be sure to look them over so that you can make the choices that are right for you.

The Glass Family of Companies 401(K) PLAN makes it easy to invest your contributions. Simply choose the approach that suits your style and comfort with investing.

Age-Based Investment

If you want a portfolio that automatically adjusts over time, consider investing in a pre-assembled target date investment.

Provides a single diversified investment designed for investors of specific ages.

Asset allocation automatically adjusts throughout a person's working years and retirement.

Build-Your-Own Portfolio

If you want more control, consider building your own portfolio.

Choose among your plan's investment options.

Manage your portfolio and asset allocation over time to suit your risk tolerance, time horizon, and financial goals.

For a full list of the investment options available to you visit

rps.troweprice.com to access investment descriptions and fact sheets.

Have questions?

We have got answers! Remember you can always contact us at